Background

Program is currently closed and not accepting new applications.

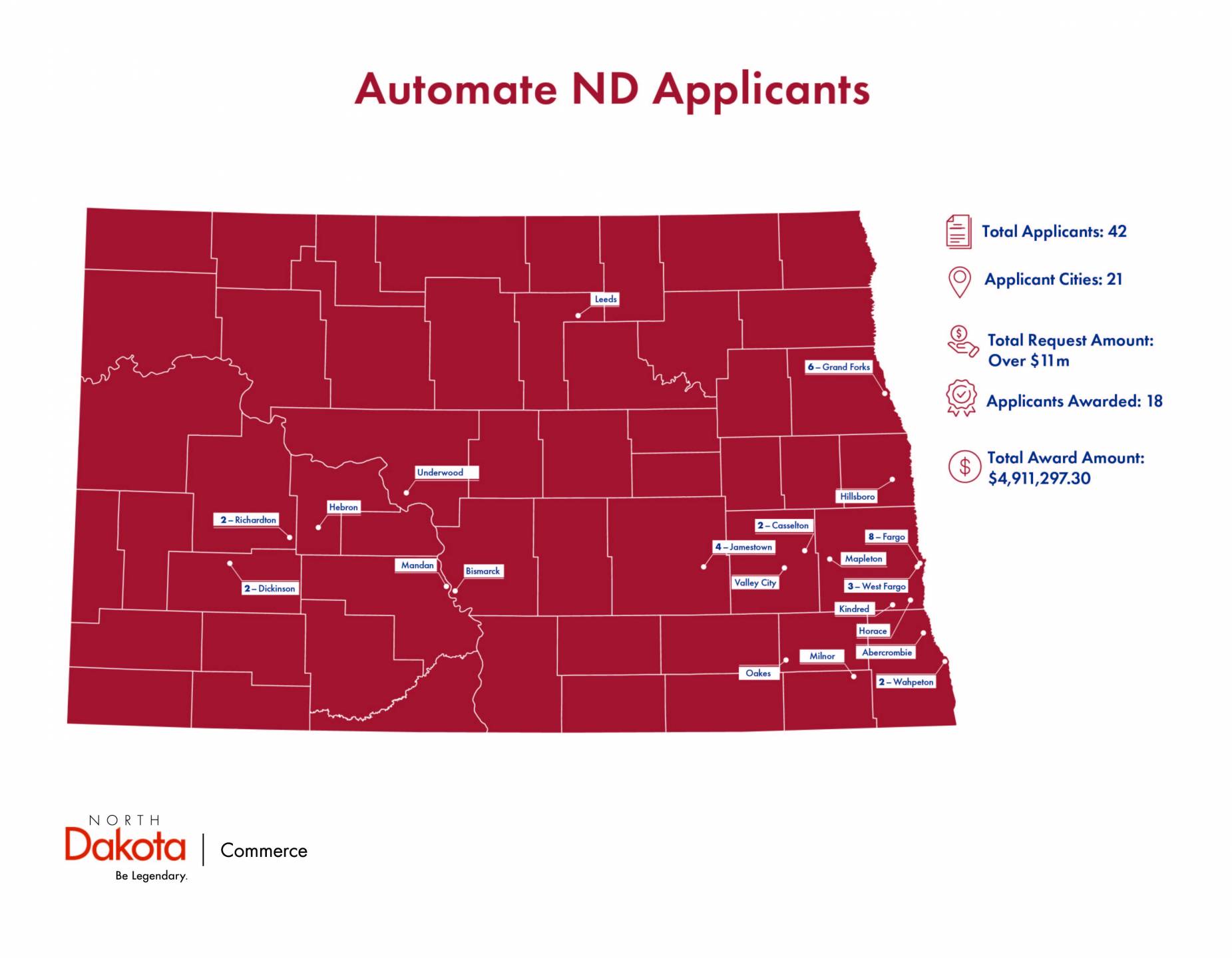

The North Dakota Development Fund received $5,000,000 during the 67th Legislative Assembly Special Session in American Rescue Plan Act (ARPA) funding for a grant program. Automate ND was developed in response to the workforce shortage in North Dakota which was exacerbated by the COVID-19 pandemic. As of February 2024, North Dakota has over 30,000 open jobs and has the lowest unemployment rate in the country. Companies in ND are facing growing customer demand but lack the workforce to enable expansion and increased productivity. Automation can help increase the productivity per employee and allow companies to expand without hiring additional talent. Impacts of automation include increased company profit, higher wages for employees, improved employee satisfaction, and an increase in state GDP.

The Automate ND Grant Program will make grants of up to $500,000 to North Dakota Primary Sector Certified (PSC) businesses (I.e., manufacturing, ag processing, etc). The grant cannot be more than 50% of the machinery, equipment, or software being purchased.

The Department of Commerce offers complimentary grant programs through its Workforce Division.

- Are you facing challenges with workforce and need assistance determining the feasibility of automated equipment, machinery, or technology? The Technical Skills Training Grant is accepting applications for grants to cover the cost of a feasibility study related to automation, including the feasibility study required with this grant application.

- Do you need to upskill your staff to run your new automated equipment, machinery, or technology? The Technical Skills Training Grant is accepting applications for grants to cover the cost of upskilling employees.